By Jonathan G. Wiik, Vice President, Health Insights, FinThrive

As 2022 draws to a close, we reflect on one of the worst financial years for U.S. hospitals. The latest reports are showing the 10th straight month of negative margins, labor issues persist and volumes have yet to stabilize. Not what we want to see as we go into the holiday season, which is hectic even in a banner year. I’ve read the reports, analyzed the data, and identified some keys to recovery for healthcare executives. I’m hopeful these bring you some good cheer as we close out 2022.

Volumes Show Signs of Recovery; However, Expenses Outpace Revenue

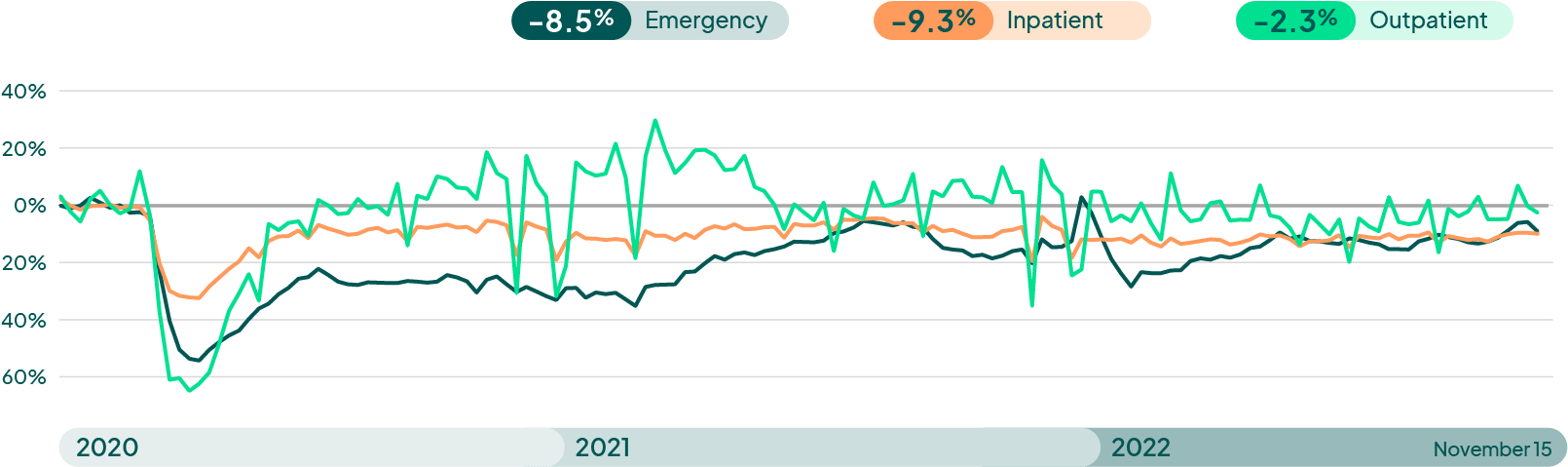

Hospital visits experienced some stabilization in November for outpatient (still below pre-pandemic levels at -2.3%) and emergency department visits (below normal by -8.5%). Inpatient visits remain relatively flat at -9.3%. In aggregate, overall volumes are -6.4% less in 2022 than in 2021 YTD. That is amplified in outpatient (-9.8%) and inpatient (-3.1%). Emergency department visits have shown the most recovery at a +3.5% increase compared to 2021. From the market research below, the market may experience single-digit recoveries in volumes as hospitals patients schedule in advance of benefit exhaustion for calendar year-end plans in Nov/Dec typically. However, outpatient visits may become volatile into the holidays, and dip down during the holiday weeks, with a net impact of negative.

Weekly visit volumes by treatment setting

Source: FinThrive Proprietary Data (n=500 hospitals)

Labor Issues Effect Expenses and Patient Flow

According to the recent November Kaufman Hall National Hospital Flash Report, hospital margins have not been profitable in 2022. Ten consecutive months of negative margins have created a deficit for hospitals that has outweighed any prior financial struggles during the pandemic. The report highlights major factors that have contributed to the poor financial performance, with many pointing to the labor crisis as the root cause:

1. Expenses outpaced revenue

Labor, outsourcing services at a premium, and inflationary supply costs are all making the expense side of the equation higher.

2. Patient flow

Capacity constraints due to clinical labor shortages have backed up the system. There are not enough beds to place patients because there are not enough nurses, and patients are boarding in the ED. Patients cannot get discharged efficiently as the bed shortage exists in the post-acute space as well. Patients are staying longer in the hospital, but reimbursement often does not translate to revenue.

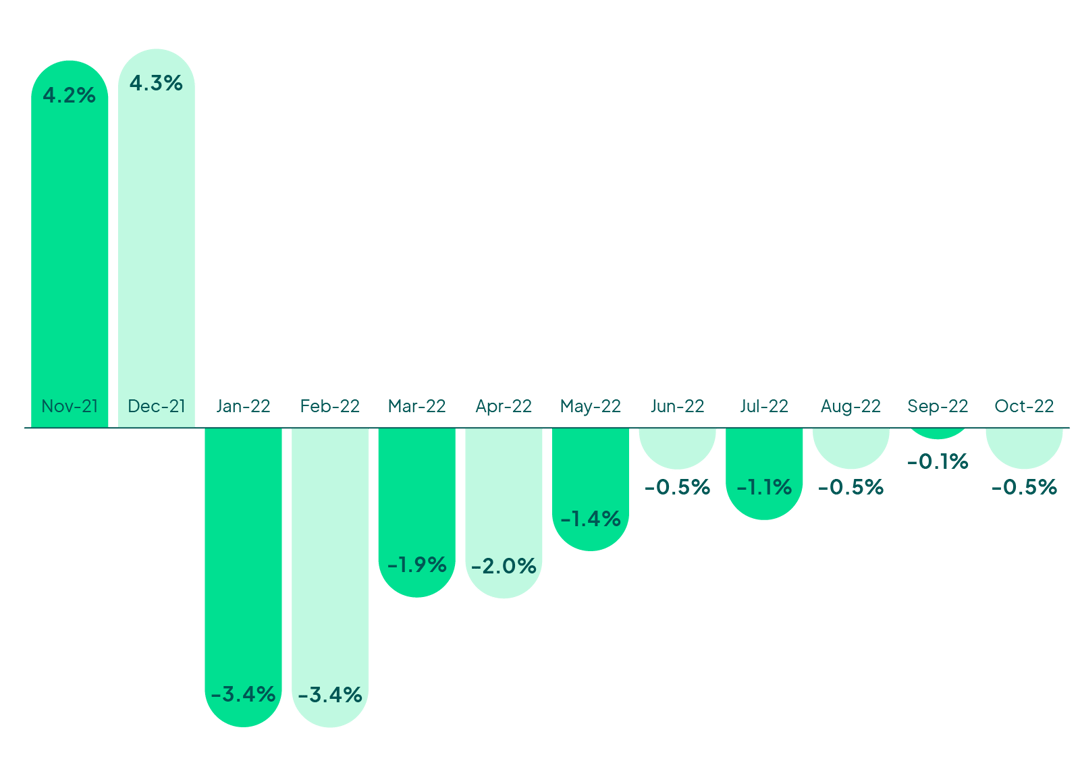

Kaufman Hall Operating Margin Index

Source: Kaufman Hall State of Healthcare Performance Improvement Report (November 2022)

What to Expect Moving Forward

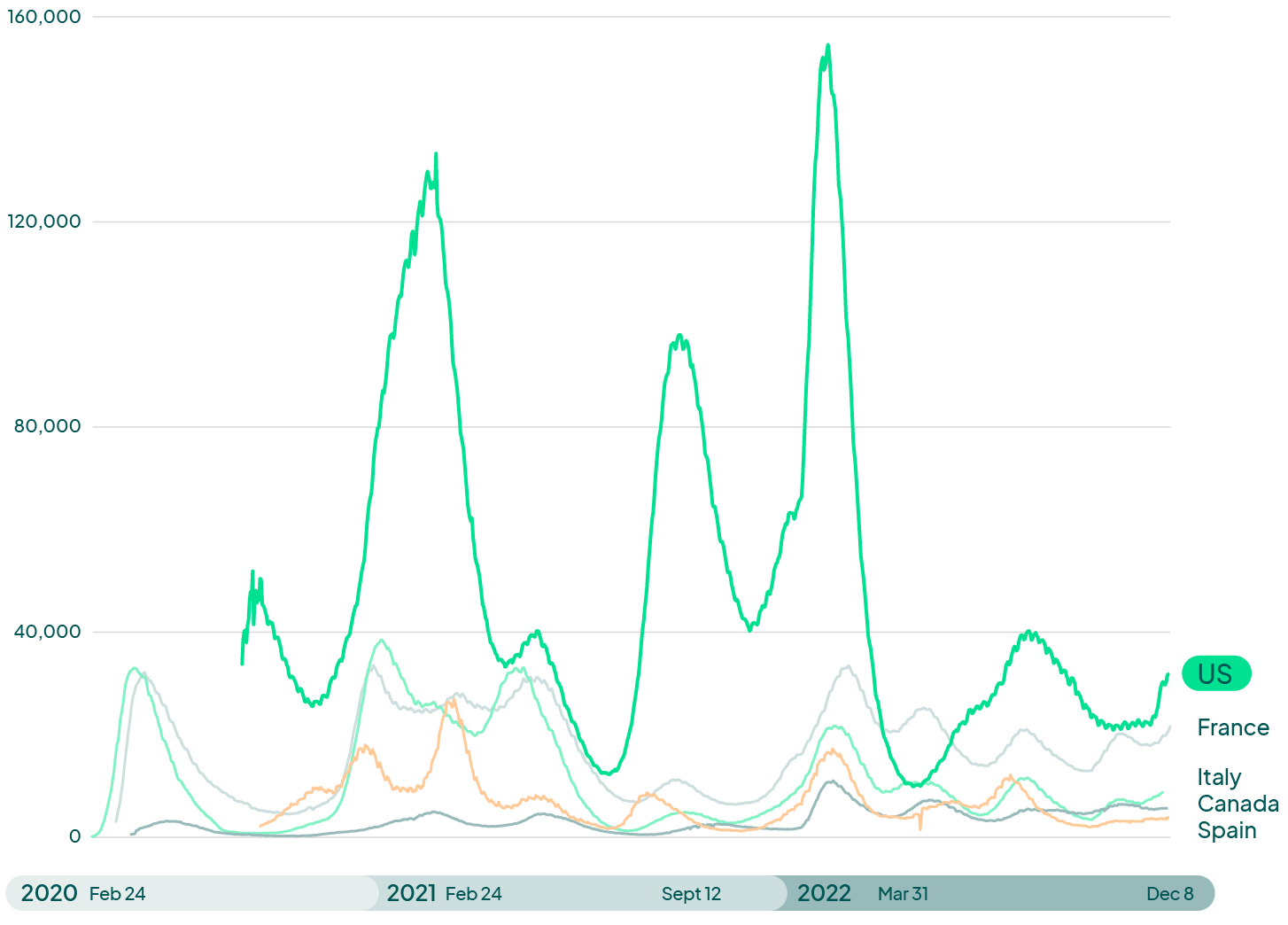

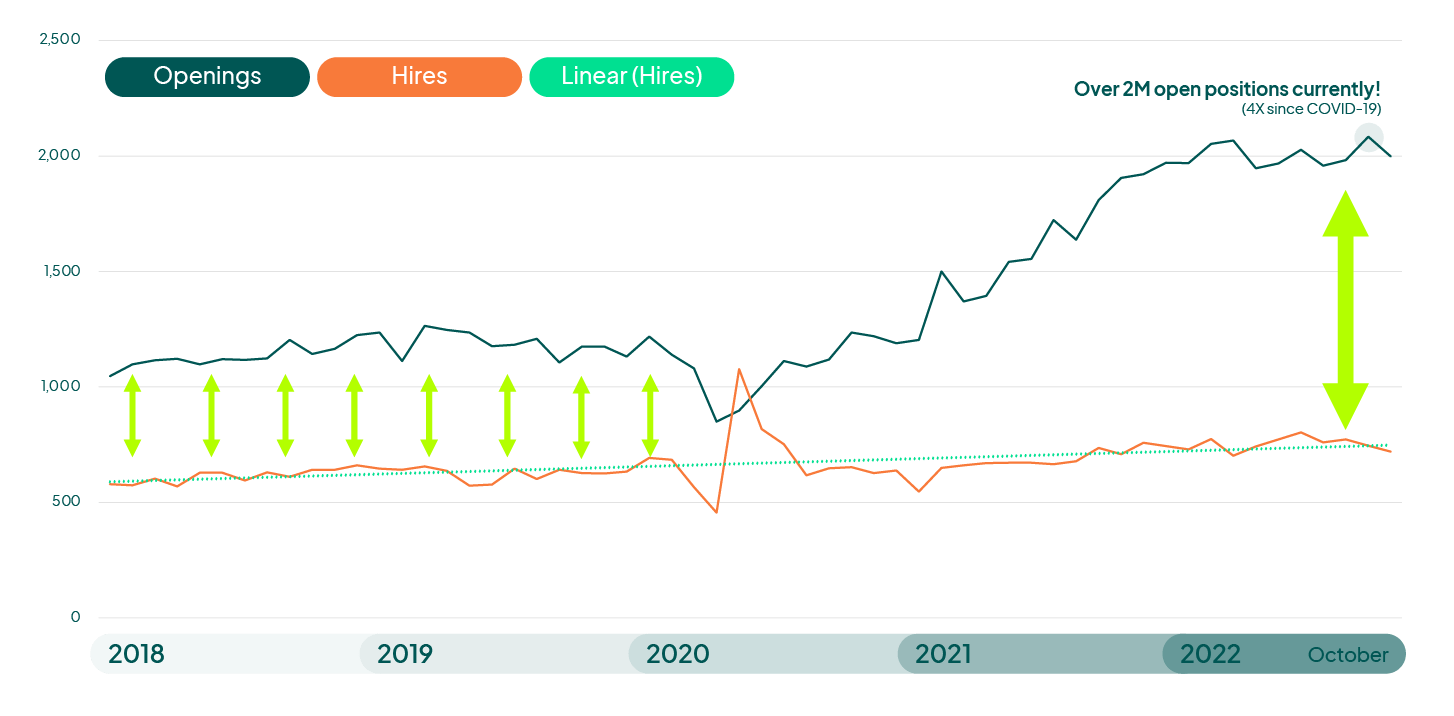

Market forces will continue to place margin pressures on hospitals. COVID-19 admissions are up 20-30%, which will further strain patient flow/capacity issues. On the bright side, labor has seen some recovery in the 4th quarter although there are still 1M+ open positions, without much change in trend. The “three-headed monster” of labor shortages, volatile volumes, and declining/shifting reimbursement will continue to shrink margins for most hospitals and systems into 2023-2024. Most analysts are indicating 2023 as a year of recovery for hospitals.

Number of COVID-19 patients in hospital

Source: Official data collated by Our World in Data- Last updated 9 December 2022

US healthcare position openings and hirings

2018-2022 YTD (000s)- BLS Jolts Survey

Source: BLS bls.gov/jlt/data.htm

Source: BLS bls.gov/jlt/data.htm

HHS also recently extended the Public Health Emergency provision for another 90 days. As each extension occurs, the administration will face increased levels of scrutiny. The next evaluation period will occur after the new year, and organizations should closely examine coverage disruptions, specifically in the Medicaid and Health Benefit Exchange coverage areas. The PHE wind down will represent a major strategic initiative for hospitals once the PHE is lifted. Hospitals can expect higher levels of self-pay and patient bad debt risk as disruptions in coverage occur in the event of a Public Health Emergency expiration. It will be imperative to ensure the cash position of organizations is insulated to offset top line revenue risks from lost coverage.

Keys to Recovery

Health systems and hospitals will need to make some tough decisions over the course of the next few months and into 2023. As volumes remain volatile without the CARES Act safety net funding, organizations will need to throttle any premium expenses from outside parties and move toward critically necessary expenses. Outpatient services will also transition into retail at some pace, for a myriad of reasons. Certain areas of hospital operations will be closely evaluated for reduction or consolidation. As labor recovers (ever so slowly), capacity and patient flow will return mid-2023.

Cash flow and expense management should be operational priorities into 2023. Health systems and hospitals should focus on projects and partnerships that retain patients and staff, deliver cash rapidly, all with minimal operational disruptions. Payer relations and accountability with a robust analytical approach is integral to maximize reimbursement from private and public payer sources. Organizations can no longer "cut costs" out of this deficit and cannot replace human capital to pre-pandemic levels. Revenue management automation efforts to boost productivity and staff satisfaction should be carefully considered. Vendor relationships should also be closely evaluated to ensure value realization is consistently occurring to justify the premium expense. Finally, critical evaluation of RCM footprint should be weighed, along with system(s) consolidation strategies to drive down expense and enhance yield.

Note From the Author

If you need a wake-up call, THIS IS IT! Healthcare is due for a shakeup, and the good news is we are all uniquely positioned to make that happen. Rethinking your revenue management strategy can be the catalyst for change in your organization. The opportunity costs are too great to remain complacent. Aggressively innovate your organization forward and build a resilient future.

Want to learn more? Request a demo or catch me at the next industry event.

About the Author

Jonathan G. Wiik, MSHA, MBA, CHFP

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.