More than 1.5 million people—including nearly 750,000 children—lost their Medicaid coverage in 2018, according to a study conducted that year. Researchers determined it was most likely due not to ineligibility but to paperwork barriers.

States with the highest drop in enrollment imposed a burdensome punitive redetermination process that relied on outdated contact information for member outreach. As a result, hundreds of thousands of eligible members lost their coverage by default when they failed to respond to notices they never received.

As we unwind from the pandemic-related Public Health Emergency and Medicaid redetermination resumes, millions of eligible members are again in danger of losing coverage. However, this year new federal Maintenance of Effort (MOE) mandates will take effect on April 1 in hopes of preventing those member losses.

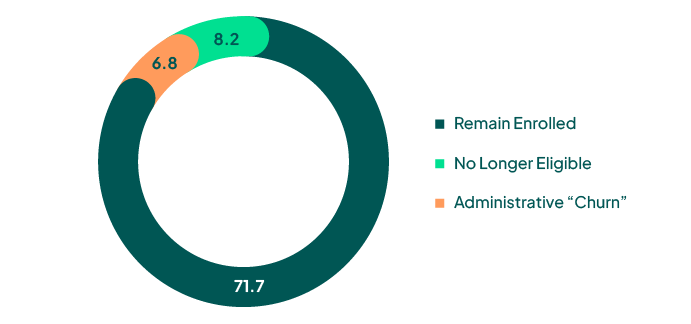

Estimated Medicaid PHE Impact (Millions)

90.6M Enrollees

Source: ASPE Issue Brief, Unwinding the Medicaid Continuous Enrollment Provision: Projected Enrollment Effects and Policy Approaches

The new mandates should not be viewed as a burden. While they require state Medicaid agencies and Medicaid MCOs to change the way they manage member outreach, they represent a real opportunity to improve processes, retain members, and prevent eligible people from losing coverage. Plus, the quality and availability of third-party data makes it extremely easy to comply.

We’re just a few weeks from the April 1 MOE deadline. Here’s what Medicaid payers need to know.

The Background

MCOs and state offices have historically relied on self-reported address data as the basis for member outreach efforts. The problem: Medicaid populations are transient and often do not update their health plans when they move. During the COVID-19 pandemic, a FinThrive analysis of customer data revealed that 24% of Medicaid members had changed addresses at least once in an 18-month period. In some areas that number can be even higher. For example, in 2021 35,000 Medicaid member ID cards were return mailed to the Health Plan of West Virginia, which represented approximately one-third of its membership.

Phone and email outreach is equally problematic when relying solely on member provided contact information. Medicaid recipients may use pre-paid cellphones and change numbers often. They may also be cautious about sharing a primary phone number and instead provide a landline or secondary number. As for email, health plans rarely have email addresses for more than 30% of their members as this information is not always collected upon enrollment. All this underscores the need both to maintain accurate data and to conduct outreach through multiple methods.

As a result of these and other re-enrollment challenges, the Department of Health and Human Services (HHS) estimates that 6.8 million people will be disenrolled this spring who are likely still eligible for coverage. Disruptions in coverage not only lead to poor health outcomes, but they also increase overall healthcare costs. One study found that adults with 12 full months of Medicaid coverage had lower average costs than those with six months of coverage.

The Solution

To help prevent massive disenrollment at the unwinding of the Public Health Emergency, the Centers for Medicare and Medicaid Services (CMS) released new Maintenance of Effort provisions on January 6, 2023.

They require Medicaid state offices to:

- Conduct renewals in accordance with federal requirements

- Make an attempt to maintain up-to-date mailing addresses using the USPS National Change of Address database, other public programs, OR other reliable sources, including mailing addresses, phone numbers, and email addresses

- Attempt to contact enrollees via more than one communication mode prior to disenrollment on the basis of returned mail

Additional guidance is supposed to be forthcoming, but proactive MCOs are planning for compliance now.

There’s an easy route: FinThrive’s ready-made Contact Confirmer solution draws from a vast identity dataset, which covers approximately 97% of the U.S. adult population and is sourced in real time from more than 5,000 proprietary sources.

We can custom-build triggers to auto-update MCOs based on changes at the individual level, such as address moves, new phones, and new email addresses. We also provide proprietary ranking scores on all addresses, phone numbers, and email addresses based on the number, quality and recency of sources seen. This gives health plans confidence to know that they are using a member’s primary contact information for outreach.

The FinThrive team is as committed to Medicaid member retention as you are. During the transition this spring, we’re offering a no-cost member contact information analysis so Medicaid payers can see firsthand how third-party verified data can solve the member outreach problem and prevent lapses in coverage.

Visit this link to request your free analysis today.