By Jonathan G. Wiik, Vice President, Health Insights, FinThrive

2022 has been one of the worst financial years for hospitals1 and most US hospitals and health systems are in a tight spot, to put it mildly. Between lower volumes, staffing shortages, higher costs, and outrageous denial rates, hospitals have been operating with negative margins for 2022.

Kaufman Hall recently released the 2022 State of Healthcare Performance Improvement Report2 and October 2022 National Hospital Flash Report3, and folks, it’s not looking good. This “new normal” of volatile patient volumes, labor shortages, and dwindling payer relations has created a three-headed monster for providers.

If you’re looking for ways to maximize your margins and get your organization back in the black, below are five strategies that drive more efficiency and lower costs.

Strategy #1

Key Areas of Focus for Increasing Hospital Margins

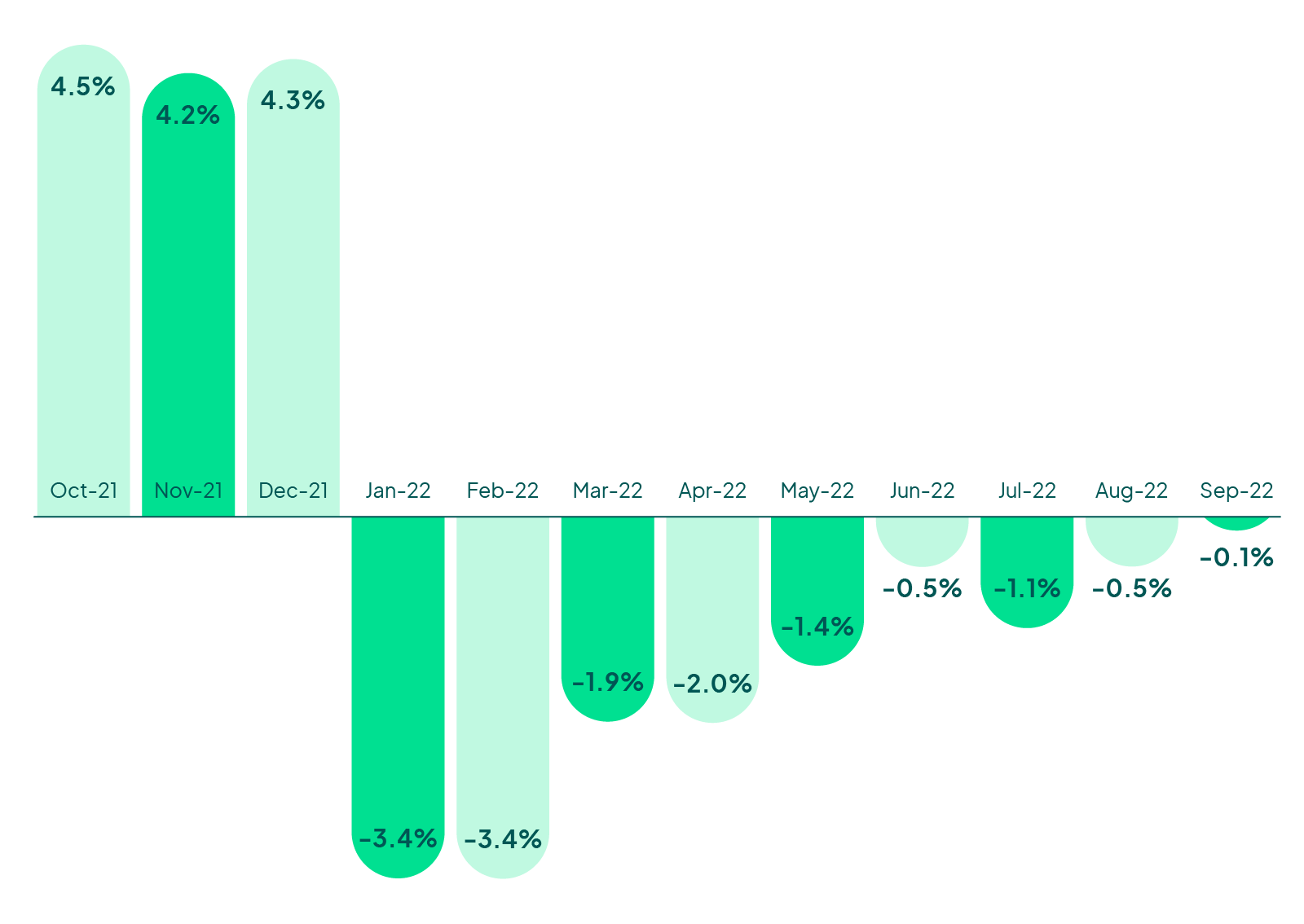

US Hospitals and health systems have experienced eight consecutive months of negative margins, with September almost breaking even at -.1%.3 Health systems that are ‘in the black’ must adjust less, but the combination of lower volumes, higher costs, and staffing shortages have put them on their strategic planning heels.

If this trend continues—which every indication shows it will—hospitals are going to be forced to make difficult decisions about the services, they are able to safely provide patients.

Kaufman Hall Operating Margin Index

Kaufman Hall, National Hospital Flash Report (October 2022)

Takeaway

As you dive into 2023 strategic planning, make sure you prioritize four areas: staff retention, payer relations, cash acceleration, and patient experience. Additionally, review 3rd party partnerships to ensure ROI and consider consolidating vendors.

Strategy #2

Offset the Labor Shortage by Outsourcing Revenue Cycle Functions

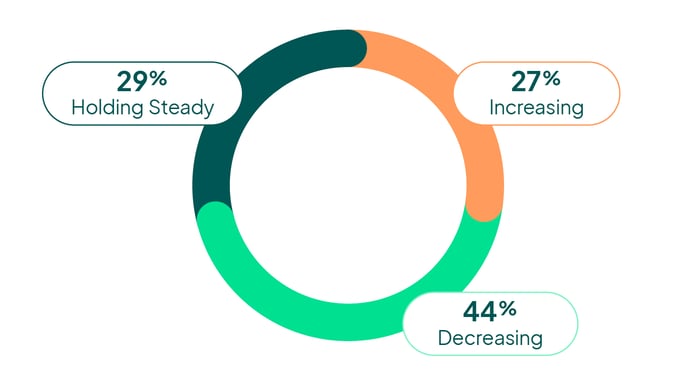

Staffing shortages have also bridled a hospital’s ability to recover. In fact, 66% of hospitals report staffing shortages that have required them to run at LESS than full capacity. This combined with the changing patient volumes has made it difficult for hospitals to plan and forecast.

Unsurprisingly, 46% of hospitals identified labor costs as their number one opportunity to reduce costs, with a trend towards outsourcing revenue cycle functions and decreasing their dependence on contract labor.2

Utilization of Contract Labor

Kaufman Hall, State of Healthcare Performance Improvement Report (October 2022)

Takeaway

Automate, automate, automate. For revenue cycle teams, this can serve two purposes – increased productivity resulting in higher cashflow and improved staff satisfaction by minimizing mundane tasks.

Strategy #3

Optimize the Financial Experience to Increase Patient Retention

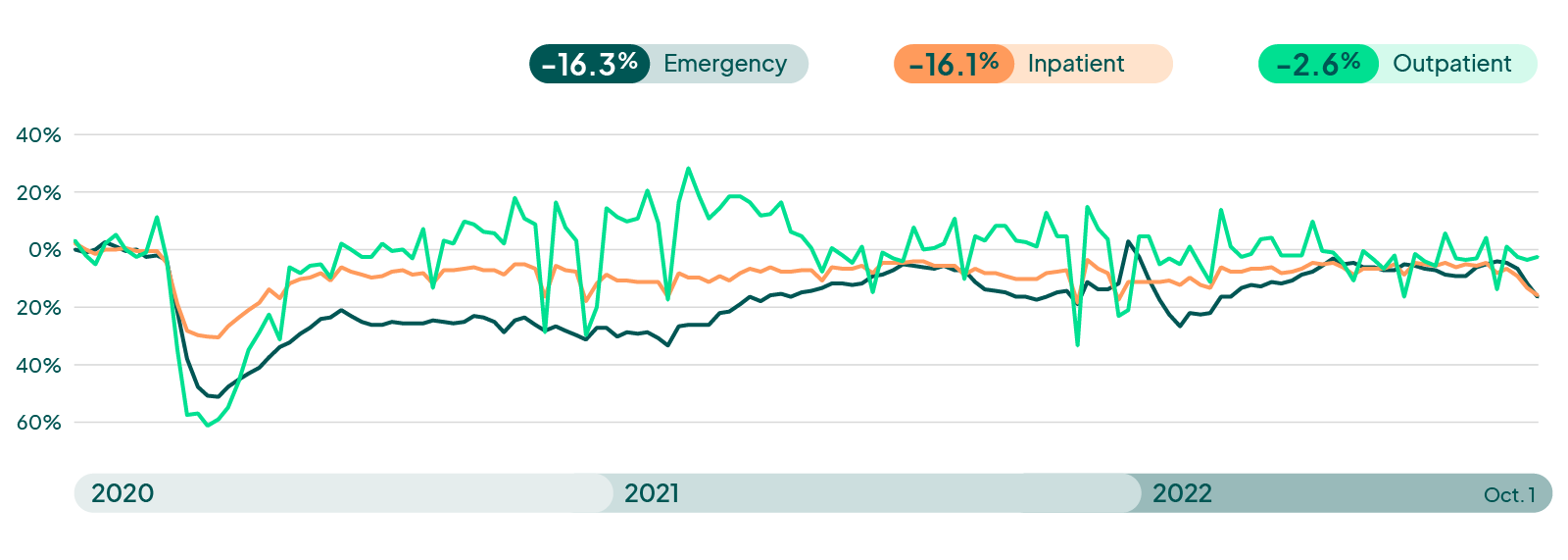

The latest data show a significant drop in emergency department and inpatient volumes, while outpatient has remained stable. These represent the lowest volumes we have seen since the beginning of the year. Inpatient and emergency department were -16% below pre-pandemic levels, and outpatient remained relatively flat at -3%.

Several sources have indicated that the emergency department and inpatient volumes will not likely return for the remainder of 2022 and will hinge tightly on the industry’s ability to address the staffing crisis, which could take years.4,5

Many question whether volumes will ever return to pre-pandemic levels and if the pandemic represents an inflection point in healthcare, shifting care into outpatient, virtual and home settings, all of which saw less of a decrease and, in some cases, may even have increased volumes.

Hospital Weekly Visit Volumes

Takeaway

There must be a major focus on patient retention. A patient’s financial experience is taking on greater importance - devoting time and effort to create a patient-focused journey. Deliver prompt and accurate estimation, financially clear patients, and assist patients in navigating their care and coverage.

Having an insurance discovery solution, even as a safety net, can be a game changer for self-pay and under insured patients. Finding unknown coverage drives revenue and creates better patient satisfaction. Working with an external insurance discovery partner can help you identify payment opportunities—up to 7%—which were initially missed. This hardest-to-find coverage can translate into millions of dollars annually.

Finally, reduce leakage by referring to it within your network whenever possible. Consumers have lots of choices on where to get the care – the total lifetime value of EACH patient is 100s of thousands of dollars. Your bottom line cannot afford any deflections in patient volume.

Strategy #4

Focus on Payer Relations to Reduce Denial Rates

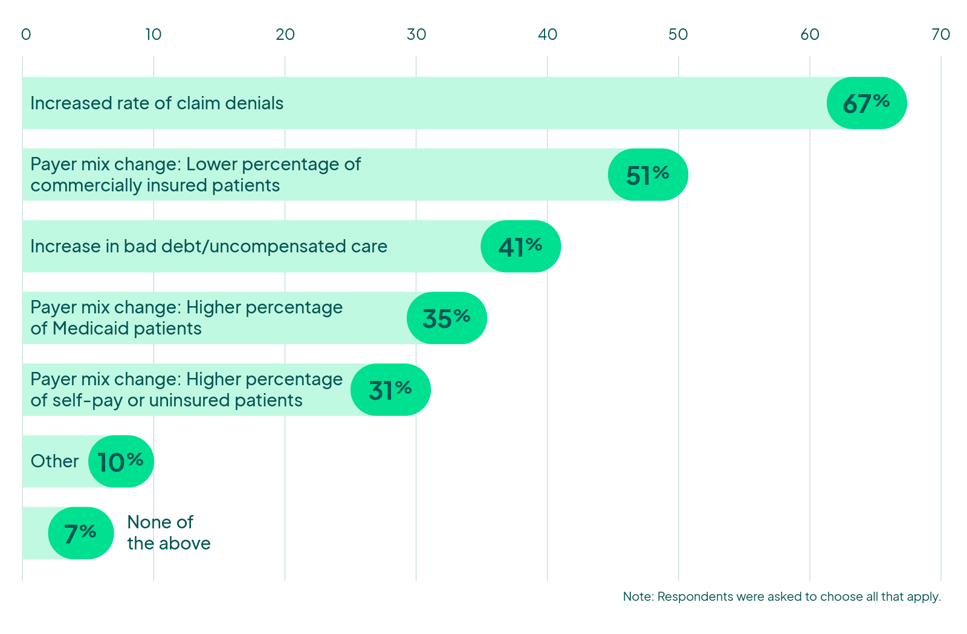

Skyrocketing denial rates may be due largely to strained payer relations. Payers had a windfall of claims during COVID-19 and now that patients are coming back, along with the claim risk, payers are enacting more rules to minimize the shift.

Impacts to the revenue cycle have been significant this year:2

- 67% reported an increased rate of claim denials

- 51% seeing diluted payer mix

- 41% increase in debt/uncompensated care

Impacts on the Revenue Cycle Over the Past Year

Kaufman Hall, State of Healthcare Performance Improvement Report (October 2022)

Takeaway

Hospitals that continue to see positive margins report a sustained focus on the overall health of their revenue cycle. While payer demands seem to change with the seasons, a focus on denial prevention can help alleviate the strain and avoid encountering the same denials over and over.

Strategy #5

Review Your Revenue Cycle Management with an Expert

Amid all this financial noise, government mandates, regulations and audits are still coming down the pipe. The No Surprises Act is one of the most complicated pieces of legislation hospitals have seen since the Affordable Care Act. It is important to understand what’s needed and set a plan in motion to become compliant before it’s too late and your organization faces hefty fines.

Finding a partner who has expertise in these regulations and has battle-tested the workflows is critical to keeping you out of hot water with regulators. Our patient access solutions deliver the price transparency your patients expect—and the government mandates—as well as resources and tools, to better understand the financial aspects of their care.

Takeaway

Many successful hospitals are turning to strategic partnerships rather than trying to do it all in-house. Look for partners—not vendors—who will work closely with you and share in your successes.

Note from the Author

Throughout my travels, I have had the pleasure of talking with healthcare leaders from every corner of the country, and one thing I can assure you is that you are not alone. From Hawaii to Maine, 15-bed rural hospitals to mega-IDNs, the struggle is real. But there’s hope!

Revenue management done right is a transformative force in healthcare. It can move your organization from playing catch-up to building a future resilient to change.

Want to learn more? Request a demo or catch me at the next industry event.

About the Author

Jonathan G. Wiik, MSHA, MBA, CHFP

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.

Works Cited

1 LaPointe, Jacqueline. Rapid Recovery Unlikely as Hospitals Face Worst Financial Year Yet. Revcycle Intelligence. [Online] October 27, 2022. [Cited: November 2, 2022.]

2 KaufmanHall. 2022 State of Healthcare Performance Improvement: Mounting Pressures Pose New Challenges. Chicago, IL : Kaufman, Hall & Associates, LLC, 2022.

3 KaufmanHall. September 2022: National Hospital Flash Report. Chicago, IL : Kaufman, Hall & Associates LLC, 2022.

4 Vizient, Inc. Post-COVID, Hospital Inpatient Volumes Recover and Patient Length of Stay Expected to Rise: Sg2 Impact of Change. Business Wire. [Online] June 7, 2022. [Cited: November 4, 2022.]

5 Decreased hospital admissions through emergency departments during the COVID-19 pandemic. Nourazari S, Davis SR, Granovsky R, Austin R, Straff DJ, Joseph JW, Sanchez LD. Am J Emerg Med, April 2021.