By Jonathan G. Wiik, Vice President, Health Insights, FinThrive

Welcome to the March edition of Healthcare Revenue Management Insights. Just as we’re starting to see flowers poking up through the snow (those of us in Colorado, at least), hospitals have reason this spring to be cautiously optimistic that things are slowly improving. Let’s take a closer look.

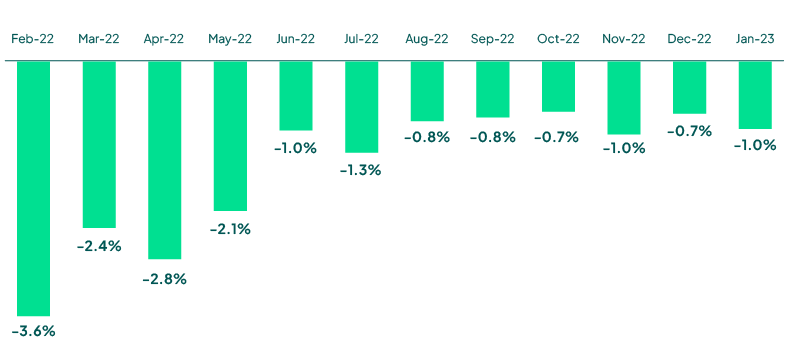

The February Kauffmann Hall report shows that signs of recovery are evident, although hospitals are still struggling to post a positive margin. Although Kauffmann Hall had projected a positive margin for December in their previous report, they have since revised that number. Negative margins will persist as headwinds from labor, inflation, and volume deficits continue. I remain optimistic that the market will slowly recover as we progress through the year. Resilient organizations will drive revenue through patient loyalty programs, successful payer contract renegotiations, and automation or organizational efforts to mitigate staffing expense surges.

Operating Margin Index by Month

Source: Kaufman Hall February 2023 National Hospital Flash Report

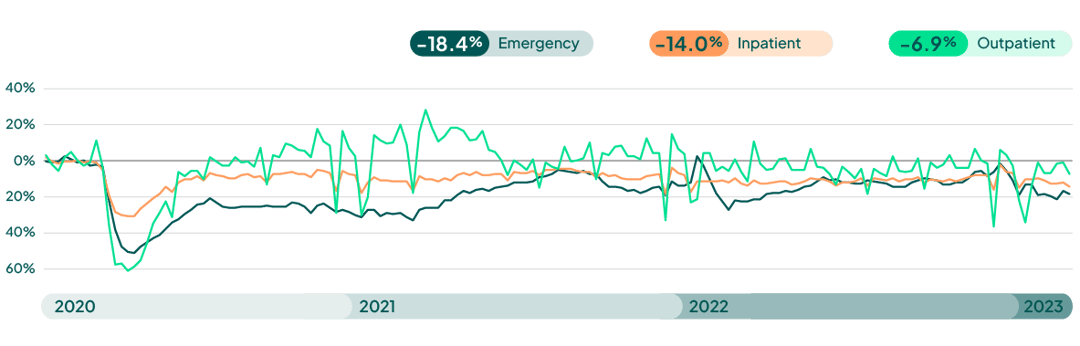

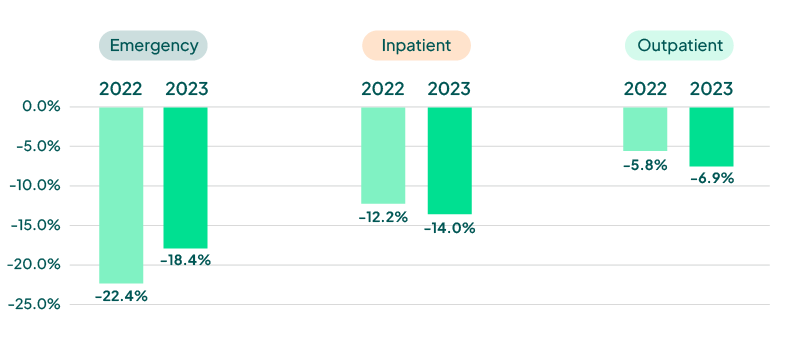

Hospital visits remained below pre-pandemic levels for the first two months of 2023. The latest FinThrive volume report reveals a deficit in January and February in the -5% to -20% range across all settings. A YOY comparison to 2022 reveals little change in hospital visit volumes as Emergency, Inpatient, and Outpatient all were within 1-3% of the deficit from 2022. Many hospitals are desperately attempting to regain these volumes through engaging patients within their community and highlighting the quality of their services.

The shift to ambulatory is apparent and there are increased pressures from the retail healthcare industry as well as volumes transitioned away from acute settings. As these visit volumes remain below “normal,” hospitals will continue to tighten their belts and look for ways to bridge the gap between declining revenue and higher expenses.

It remains critical that organizations rethink their revenue management strategy and look to best-in-class workflows and solutions as well as opportunities to remove inefficient or duplicative systems. Vendor consolidation at the hospital level will lead to enhanced yield, lower administrative expense, and higher staff satisfaction. Cash acceleration is a leading strategic priority for hospitals – they need to maximize revenue from patient and payer.

Weekly Visit Volumes by Treatment Setting

Source: FinThrive Proprietary Data (n=500 hospitals)

Weekly Visit Volumes by Treatment Setting

(Year over Year Comparison – week 2/5)

Source: FinThrive Proprietary Data (n=500 hospitals)

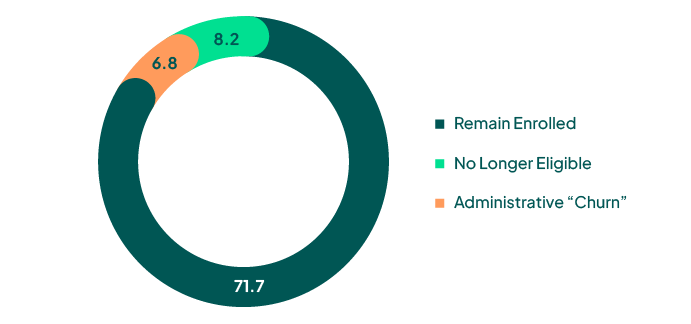

Last month, the White House announced the end of the public health and national emergency declarations that were put into place in March of 2020. The “unwinding” of Medicaid continuous coverage provisions will have a ripple effect to all areas of the healthcare market. According to the Assistant Secretary for Planning and Evaluation (ASPE, a division of HHS), 15 million Americans are at risk to lose Medicaid, impacting one in five members. Providers, payers, and state agencies must make a concerted effort to minimize disruptions in coverage and ensure barriers to care are mitigated.

Any time there is a change in enrollment criteria, whether the beneficiary is eligible or not, it causes confusion and care is often avoided. Administrative “churn” will impact roughly 50% of the disrupted Medicaid enrollees (7M) and outreach, education, and redetermination resources must all be elegantly executed in the coming year. Without them, organizations can expect to see disengaged patients, higher acuities, and administrative burdens, which will strain already fragile hospital and payer workstreams.

Payers can expect to see a level of disengagement and higher care costs as patients defer care for fear of cost. Hospitals may have determinantal impacts to their bad debt portfolio. Organizations must ensure they have a solid plan in place and are leveraging technology to verify member/patient contact information, and that all possible areas of coverage are identified to ensure care and payment are not disrupted. I will be closely monitoring the impacts month to month and will report on the latest.

Estimated Medicaid PHE Impact (Millions)

90.6M Enrollees

Source: ASPE Issue Brief, Unwinding the Medicaid Continuous Enrollment Provision: Projected Enrollment Effects and Policy Approaches

What’s should we expect for the rest of the year?

2023 will be a year of recovery for healthcare. Margins remain negative and are recovering at a snail’s pace while headwinds from labor, volumes, and payer relations anchor progress. The unwinding of Medicaid will impact every aspect of the healthcare market in spades. This will be a differentiating year in our industry. We will observe resilient, innovative, and strategic organizations succeed, and we will sadly see fragile organizations struggle.

COVID changed the game. Organizations must get out of the mindset of “getting back to normal.” We have a new normal that demands greater efficiency, collaboration with payers, and respect for people. To accomplish these goals, revenue management must be retooled to a new paradigm. Automate, don’t recreate. Take an inventory of your RCM footprint and crucially evaluate yield and performance. Consolidate to those that perform and then optimize over time. These actions are truly mission critical.

I’ll say it again: the healthcare market is in the unique position of creating something different – really rethinking their revenue management. Accelerating cash, reducing expenses, and retaining staff should all be operational priorities behind delivering care to your communities. As our industry financially recovers, as stewards of the healthcare dollar, we are obligated to navigate our organizations through this storm leaving no rock unturned.

About the Author

Jonathan G. Wiik, MSHA, MBA, CHFP

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.