We're here to help!

Have a question or want to learn more?

Contact UsAccording to a recent survey from the Healthcare Financial Management Association (HFMA) and Eliciting Insights, hospitals and health systems find themselves navigating financial hurdles amidst lower reimbursement rates and increased denials. As a result, these organizations operate on razor-thin margins and inch closer to a financial breaking point.

To boost bottom lines, healthcare organizations can look to reduce costs, but one area to address could be patient collections. With high-deductible health plans on the rise, more patients are unable to afford their healthcare out-of-pocket costs, leaving many providers high and dry as they take on more bad debt.

A significant amount of unpaid debt is due to balances remaining after insurance payouts. To address this, implement robust point-of-service collection strategies. Targeting the HFMA-recommended 3-5% collection rate of net patient revenue at the point of service can make a substantial difference.

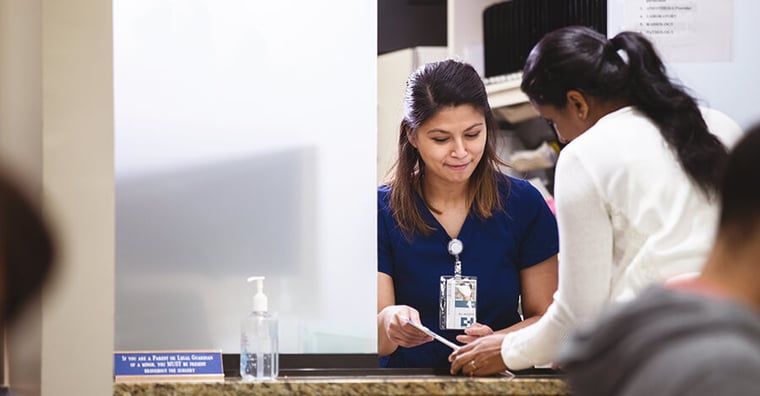

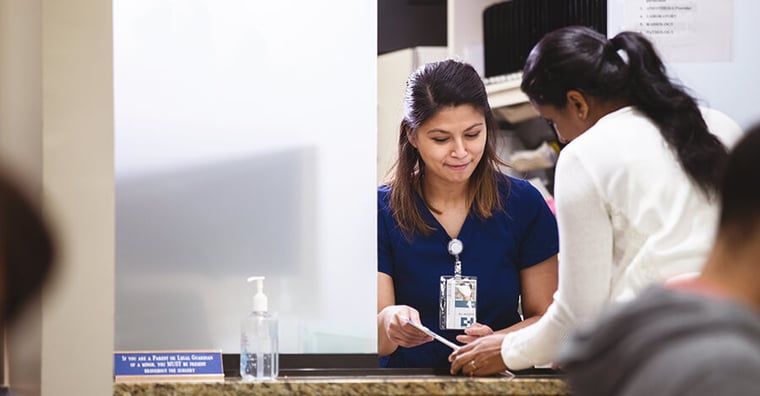

This involves not only leveraging advanced payment technologies to provide a more convenient and streamlined patient financial experience, but also ensuring front-line staff are well-trained to handle sensitive financial discussions with empathy and clarity.

Empowering staff with the right RCM technology as well as regular training and support enables them to confidently negotiate payment plans and collect outstanding balances at different registration points, and ultimately improving overall collection rates at the point-of-service.

RELATED: 5 Patient Experiences that Must Be Digital

Accurate insurance verification is foundational to effective patient collections. Utilizing digital solutions for real-time insurance verification helps in identifying coverage details and patient responsibilities upfront, reducing the risk of claim rejections and enhancing the likelihood of collecting due amounts.

Furthermore, streamlining the pre-service prior authorization process ensures that all necessary approvals are obtained before services are rendered, minimizing the risk of post-treatment collection hurdles. By investing in technology and processes that facilitate these verifications and authorizations early, healthcare organizations can significantly reduce financial uncertainties and improve collections.

RELATED: Fixing Inefficient and Costly Prior Authorization: A Path to Modernization

A recent survey unveiled that 65% of patients are more inclined to make at least a partial payment if they receive a cost estimate before the service. This underscores the critical role of transparent and upfront financial communication in the healthcare billing process.

To meet this demand, healthcare providers should harness technology to deliver precise and detailed cost estimations to patients prior to any service.

By doing so, patients can better understand their financial obligations and plan accordingly, which in turn can alleviate the stress associated with medical bills. Offering clear, accurate cost information can significantly simplify the billing experience for patients, leading to a higher rate of payment completion and a more trustworthy patient-provider relationship.

Efficiently collecting patient payments requires seamless teamwork. It's critical to ensure that the clinical staff is fully aware of the financial implications of their work. By cultivating a strong partnership between the clinical and billing departments, both teams can work together more effectively.

This collaboration helps in preventing any potential misunderstandings or miscommunications that might arise, which could otherwise interfere with the collections process. Engaging both teams in regular communication and training sessions can foster a better understanding and appreciation of each other's roles in the financial health of the organization.

For healthcare organizations looking to stabilize their financial health and improve those razor-thin margins, these approaches provide a solid foundation to enhance patient collections for a stronger bottom line.

For even more tips about how to reduce bad debt and collect more earned revenue, download our complete guide to increasing patient collections.

Password resets /

critical issues

800-390-7459

For non-critical issues

or requests, visit our

Community Portal