Today’s health care leaders know that tackling unchecked costs requires innovation and digital transformation. But where do you start? Automation has virtually infinite applications across the revenue cycle – where will it make the greatest impact?

We recently surveyed a group of healthcare industry CFOs to see how and where they are directing their investments. The results show a clear focus on three targeted automation use cases with the potential to dramatically impact organizations’ bottom lines.

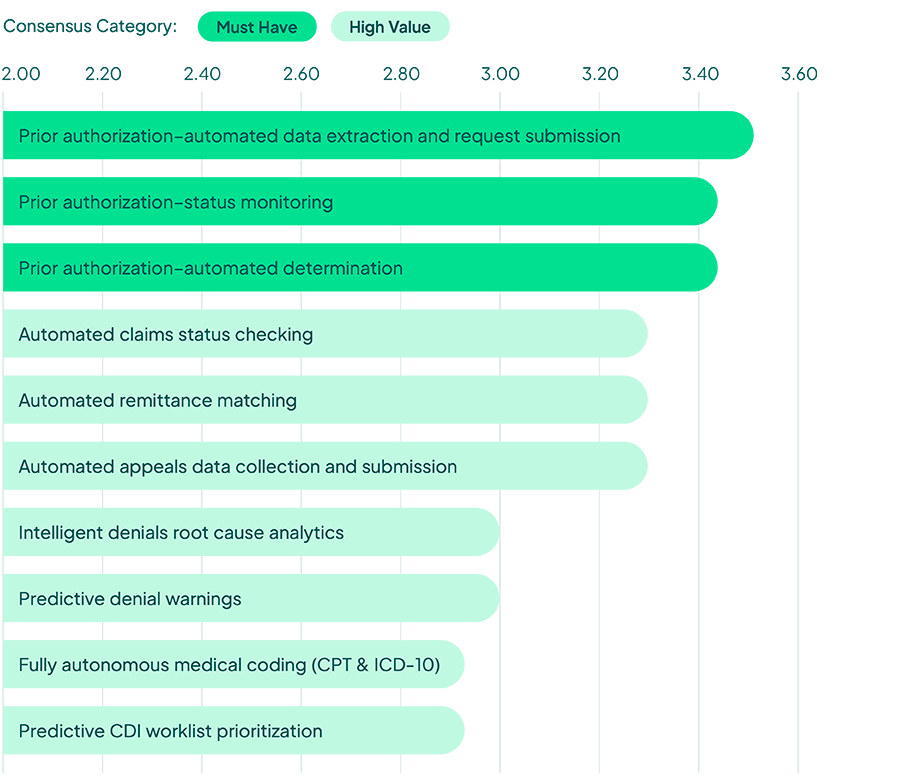

Q: Rank the following AI/ML/RPA use cases in order of value in an End-to-End RCM platform.

Average scored values for top 10 CFO ranked RCM technologies, based on a scale of 0 to 4, where 4=Must Have, 3=High Value, 2=Moderate Value, 1=Minimal Value and 0=Not RCM

When we asked healthcare finance leaders to rank their perceived value of artificial intelligence (AI) and robotics process automation (RPA) use cases across revenue cycle management, key trends quickly emerged. Prior authorization was a clear winner, with three use cases scoring as “must-haves.” Claims processing followed, with the management of denials close behind, both ranking as “high value” use cases. Let’s take a closer look at each of these three opportunities.

Prior authorization is the most sought-after automation capability

The automation of prior authorization processes is a priority for health system leaders. In fact, a consensus majority of CFOs consider it a “must have.” This is not surprising, given that prior authorizations were cited as one of the most expensive administrative tasks for providers in 2020 per a CAQH report.

Front office staff manually check ever-changing prior authorization requirements on behalf of patients to determine when approvals are needed. Then, they must gather and submit the necessary documents for consideration, only to repeatedly monitor the status of their request. Supporting this manual process costs providers millions per year.

Using automation technologies, this load can be lightened for staff. Today, RPA and predictive analytics are being used to flag when prior authorization is needed. Automation technologies can gather necessary documentation and autocomplete prior authorization request forms. Bots then submit requests across appropriate channels and return to check for updates.

The benefits of automating prior authorization tasks are clear. From a time-savings standpoint, health systems are realizing an average 65% reduction in time spent on manual prior authorization. They also report a 38% average reduction in time to receive a final decision on the request, allowing patients to access care faster. The financial implications of automating prior authorizations can be seen through reductions in denials, reductions in write-offs, and increased collections.

Claims processing holds the most cost-saving potential

Automating claims remittance matching is the next most valued automation opportunity. According to the same CAQH report, electronic claims status checking has the highest potential to generate direct cost savings. CFOs agree, citing claims status checking and remittance matching as the highest-rated use cases for automation outside of prior authorization.

Health systems are beginning to deploy RPA and computer vision technology that allows bots to navigate payer portals, check claim status, and update provider billing software. Some go further, automatically advancing claims that have been paid so they drop off worklists and flagging denied claims, or claims that require additional information, so that appeals work can begin faster.

Health systems are increasing remit matching by moving from paper to electronic remits, and by implementing optical character recognition (OCR) and batch scanning to move paper-based remits into electronic automation workflows.

In this space, algorithms are being used to match electronic remit advices (ERAs) to actual payments and originating claims. RPA is being used to post the payments to patient accounts. While this may handle most claims, there are still exceptions that require human attention. Machine learning (ML) techniques are solving this problem, allowing automated systems to learn how to handle complexity, so limited human intervention is necessary.

Automation will be critical to managing denials

According to a study by the Medical Group Management Association, more than 50% of denied claims are never reworked. Each reworked claim costs approximately $25 in added labor. CFOs are looking to automation technology to bring auto-appeal capabilities to life.

Today, most denials go unworked due to the manual labor involved. To rework a denied claim, providers first need to identify the reason for denial. Health systems are automating the root-cause analysis of denials by extracting remark and remit codes from the 835 responses. Denials are then being auto-categorized into “reasons for denial” buckets, such as authorization, eligibility, or patient responsibility. Denial worklists are then prioritized based on probability that the decision will be overturned on appeal. Complex cases are routed to employees, while simple cases can be automatically forwarded through an automated appeals process.

Organizations are using RPA to prepopulate payer-specific appeals forms with the information typically provided on similar successful appeals cases. Vendors that leverage ML will incorporate a feedback loop to continue monitoring inputs that lead to a positive appeal outcome for each denial type. The ROI of automating denials-related tasks is measured through increased collections, number of billing FTEs redeployed to other areas of the business, and the overall reduction in denial processing time.

Automate prior authorization, claims processing, and denials management in one platform

Unlike point products that only address one portion of the revenue cycle, FinThrive brings AI and RPA to the entire process. Our end-to-end revenue management platform delivers a smarter, smoother revenue experience that increases revenue, reduces costs, expands cash collections, and ensures regulatory compliance.

Read the full guide on how end-to-end autonomous revenue cycle management from FinThrive helps organizations confidently move toward profitability. Or if you are ready to speak to us now, contact FinThrive.