On May 11, 2023, the federal Public Health Emergency (PHE) will expire, and along with the Consolidated Omnibus Act, will impact coverage for millions of Americans on Medicaid. This is arguably the biggest thing to happen to Medicaid since the passing of the Affordable Care Act (or, depending who you ask, since Medicaid was created.) One in five people, or approximately 15 million beneficiaries, will be unenrolled and lose their coverage. This has tremendous implications for states, payers, and providers.

Before we dive into how to navigate the end of the PHE, let’s look at how we got here. In March of 2020, Congress passed the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act in response to COVID-19. The CARES Act took wide-ranging action to mitigate the social and economic impacts of the pandemic, including relaxing a number of rules around healthcare programs. These changes were broad and impactful. For all intents and purposes, the CARES Act froze Medicaid, expanding enrollment and no longer disenrolling participants if they didn’t qualify annually. As a result, Medicaid expanded from about 70 million people in March of 2020 to 95 million today.

Why are 15 million of those 95 million about to lose their coverage? A recent ASPE brief reports that approximately 9.5% of Medicaid enrollees (8.2 million) will leave Medicaid due to loss of eligibility and will need to shift to another source of coverage. Another 7.9% (6.8 million) will still be eligible, but will lose coverage due to administrative churn (actually qualify but fail to re-enroll). Most concerningly, children and young adults will be hit particularly hard, with 5.3 million children and 4.7 million adults aged 18-34 predicted to lose Medicaid/CHIP coverage.

How states are navigating the end of the PHE

These circumstances clearly set up a number of challenges. States, which are responsible for restoring “routine operations in their Medicaid, CHIP, and BHP programs,” must navigate how to disenroll Medicaid beneficiaries who are no longer eligible under the current program and re-enroll those who are. This involves educating their populations on the changes and making those changes quickly. Because each state is the payer for Medicaid, they are highly incentivized to clean up their rolls promptly. In the next few months, states must ensure that people still have coverage but also protect their budgets.

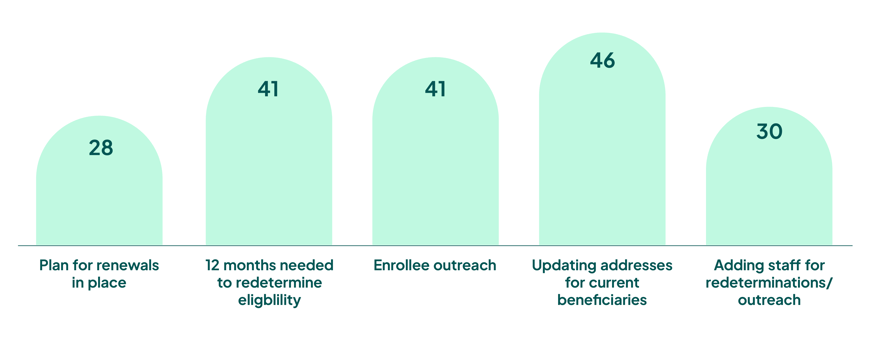

How are states tackling these challenges? The numbers, frankly, aren’t particularly promising per the Kaiser Family Foundation:

We would expect to see higher numbers given the significant potential for loss of coverage as states address the re-enrollment backlog. This is not going to be easy. With the transition to remote work, the ability to conduct routine actions is more limited. An influx of returned mail is also likely, as economic circumstances have amplified housing instability and homelessness. Plus, the financial pressures mentioned above motivate states to move quickly through redeterminations rather than take deliberate action to conduct follow-up outreach to ensure eligible individuals stay enrolled.

That’s all fine and good (or not) for the states. But what about providers?

For providers, the combination of loss of coverage and states’ rush through redetermination will dramatically impact continuity of care. As millions more patients come in without coverage, there will be serious financial and clinical implications and a monstrous administrative burden. This is particularly clear when you look at how Medicaid disenrollment will affect the revenue cycle. From scheduling and financial clearance to POS collections to increased denials, it will reverberate up and down the chain.

Medicaid disenrollment has significant impacts to revenue cycle

3 ways providers can mitigate the impact of the PHE expiration

How can providers address these challenges?

- Establish a robust outreach program.

Work with your state, community partners, health plans, and even other providers to educate Medicaid enrollees on what’s going to happen and when. This could include letters, text messages, phone calls, TV or radio ads, billboards, flyers, posters, you name it. Hawaii made the smart choice to make their disenrollment letters pink; everyone pays attention to a pink letter! The more people who understand that their coverage is ending and they need to do something about it, the fewer people who come to the hospital uninsured. Of course, for outreach to work, you need accurate and up-to-date contact information, which brings us to… - Confirm enrollees’ contact information.

One in four Medicaid beneficiaries moved during the COVID pandemic. Without updated details, your outreach won’t go through. Consider leveraging third party data to verify contact information, which eliminates the manual address verification process. - Verify patients’ insurance coverage.

This is always a best practice but will become even more important in the coming months. With the influx of people who are no longer enrolled or aren’t sure where/if they are enrolled, providers need a trusted mechanism for finding and confirming coverage. Confirming each patient’s funding mechanism as early as possible will significantly mitigate impacts to the revenue cycle down the line. Technology can help with this, too. Running insurance discovery helps providers find missed coverage across their entire set of accounts, including non-self-pay accounts. Ensure you have data matching technology with automated reports that identify billable coverage for accounts not captured on the front end. Also ensure the technology uses machine learning features to rank financial opportunities to optimize recovery and save time.

There’s no doubt that the end of the Public Health Emergency will bring tumultuous times to states, payers, and providers. With these proactive strategies, however, providers can help patients retain coverage, minimize administrative burden, and alleviate the impact to the hospital’s revenue cycle.

Schedule a demo to learn more about how FinThrive can help.