By Jonathan G. Wiik, Vice President, Health Insights, FinThrive

Welcome to the April 2023 edition of Revenue Management Insights. This month, we'll be discussing several important trends that are impacting the healthcare industry, including hospital margins, patient volumes, labor shortages, and the end of the federal Public Health Emergency.

RCM Digital Transformation Trends: What execs are turning to in 2023

In a recent survey, 87 financial leaders ranked their organization's top three corporate objectives for the year. Watch this webinar replay to unpack the findings and gain a deeper understanding of the current RCM tech adoption landscape.

Presented by: Adar Palis, Group Vice President of Clinical and Revenue Cycle Applications, Providence Health,

and Jeff Becker Vice President of Portfolio Marketing, FinThrive

Hospital margins

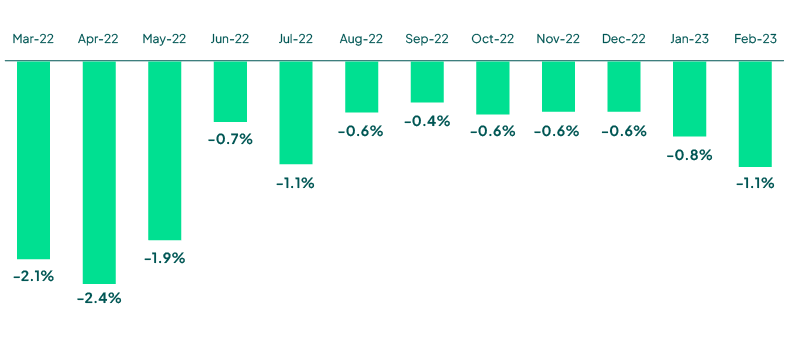

We had been seeing a steady climb out of the negative margins, but according to the latest Kaufman Hall National Hospital Flash Report, hospital margins declined significantly in February 2023. Specifically, hospitals' operating margins fell 34.6% year over year, while their gross operating margins dropped 28.2% during the same period. These declines were driven by the usual suspects, including the ongoing labor shortages, rising supply chain costs, and lower patient volumes. While hospital finances are trying to stabilize, expect flat-to-negative margins into Q2 of this year (at least).

Volumes have actually stabilized somewhat, but remain below pre-pandemic levels for inpatient (IP) and emergency department (ED). Outpatient (OP) care will be a focus for hospitals, as consumer and payer behaviors are driving the continued shift to ambulatory. The cost of supplies with inflationary pressures is outpacing the higher cost of labor, as labor savings / restructuring seem to have bottomed out. That said, hospitals are still reliant on some level of contract labor, especially in the clinical areas.

I like this quote from the report analyst, Erik Swanson, Senior Vice President of Data and Analytics at Kaufman Hall. "In this new normal of razor-thin margins, hospitals now have more reliable information to help make the necessary strategic decisions to chart a path toward financial security." This reinforces the planning and cash acceleration efforts I’ve been talking about. Hospitals should engage their business partners to optimize solutions and work toward being cash positive quickly though high-yield solutions. Consolidation efforts should also be evaluated as margins continue to stabilize (current negative margins notwithstanding.)

Operating Margin Index by Month

Source: Kaufman Hall February 2023 National Hospital Flash Report

Source: Kaufman Hall February 2023 National Hospital Flash Report

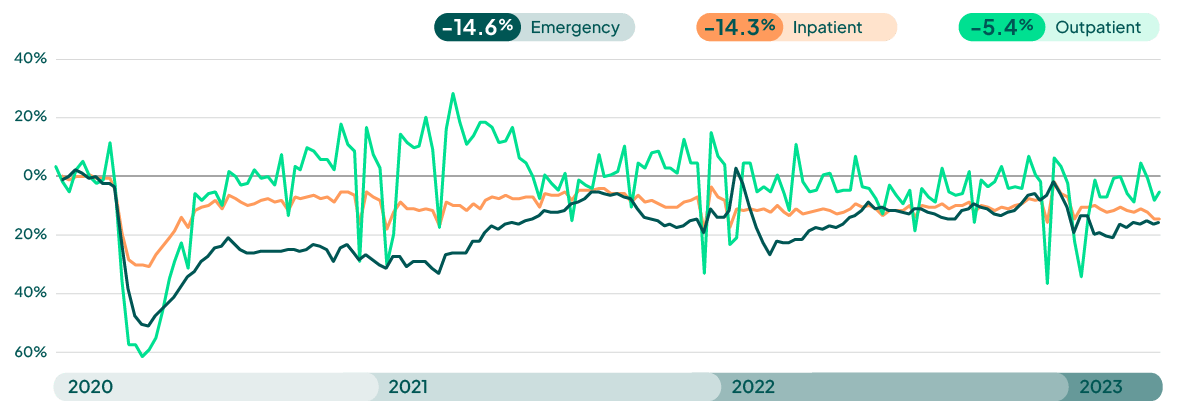

Patient volumes

Visit volumes remain below pre-pandemic levels, with ED and Inpatient levels at -14%. OP is showing some signs of recovery, but also below pre-pandemic levels at -5.4%. Expect hospital visit volumes to remain below normal into Q2, in the -5% to -20% range. We will continue to see OP recover, while ED and IP will for the most part remain below normal.

Hospitals must fundamentally change their business models in the coming quarters, as expectations of increased volumes are not coming to fruition. This, combined with poor investment portfolio performance, declining payer relations, inflationary pressures with labor/supplies, as well as the deficit created in 2022, will lead to conservative approaches to growth for most organizations. The YOY gap between revenue growth and expense growth is growing larger and will force organizations to innovate their operations wherever possible.

Weekly Visit Volumes by Treatment Setting

Source: FinThrive Proprietary Data (n=500 hospitals)

Labor shortages

The labor shortage in healthcare continues to be a significant challenge for providers, with many struggling to fill open positions. Healthcare ranked #2 in job cuts with 9,749 announced in February and 16,482 YTD—an 85% increase compared to 2022. This shortage has led to higher labor costs and increased pressure on existing staff. Hospitals are realizing that they cannot simply hire their way out of this and must look to technology to automate operations. That can include adopting new workflows, removing inefficient or redundant systems, and/or vendor consolidation, among other things, but it’s non-negotiable in the current climate.

End of the Public Health Emergency

15 million people are at risk of losing coverage over the next 12 months, representing one in five Medicaid beneficiaries. As the Public Health Emergency comes to an end, healthcare providers are grappling with several challenges. For one, they must adapt to a new reimbursement landscape, as many of the temporary changes made during the pandemic are now being rolled back. Additionally, providers must adjust to a post-pandemic patient population, which may have different needs and expectations than before. Insulation of the bad debt portfolio will be mission critical. Providers and state agencies must also ensure they have the correct contact information, the correct insured status, and have appropriate resources in place to manage this disruption.

Despite these challenges, there are also opportunities for healthcare providers in the coming months. For instance, providers may be able to leverage telehealth and other remote care technologies to reach more patients and improve their bottom lines. Additionally, providers may be able to take advantage of new reimbursement models and value-based care initiatives to better align their financial incentives with patient outcomes.

How can providers leverage these opportunities? Wide-reaching education efforts, to start, to help people understand the need to re-enroll. In addition, hospitals must be proactive about verifying patients’ contact information and coverage. These steps can mitigate the administrative burden at point of service and increase the number of beneficiaries who remain enrolled.

Overall, the healthcare industry continues to face several important challenges. From declining hospital margins to labor shortages and lower patient volumes, providers must navigate a complex and rapidly changing landscape. By embracing new technologies and value-based care models, providers can ride out these issues and position themselves for success in the years to come.

Want to learn more? Request a demo or catch me at the next industry event.

About the Author

Jonathan G. Wiik, MSHA, MBA, CHFP

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.