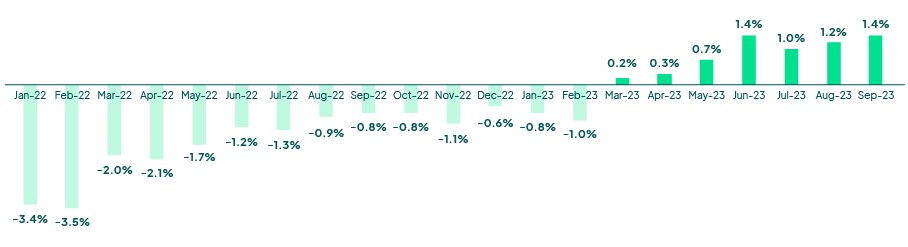

Welcome to the third quarter 2023 edition of the healthcare industry insights! Continued recovery is occurring as we start to close out 2023. Per normalized data from the September KaufmanHall report, we have seen over seven months of positive margins. Hospital visit volumes are showing some stabilization, although highly variable and remain below pre-pandemic levels. Labor and supply costs remain high but have stabilized over 2023. It will be imperative for healthcare organizations to strengthen relationships with supply chain and labor pools to minimize variability and financial impacts into 2024.

Operating Margin Index

Source: Kaufman Hall National Hospital Flash Report

Source: Kaufman Hall National Hospital Flash Report

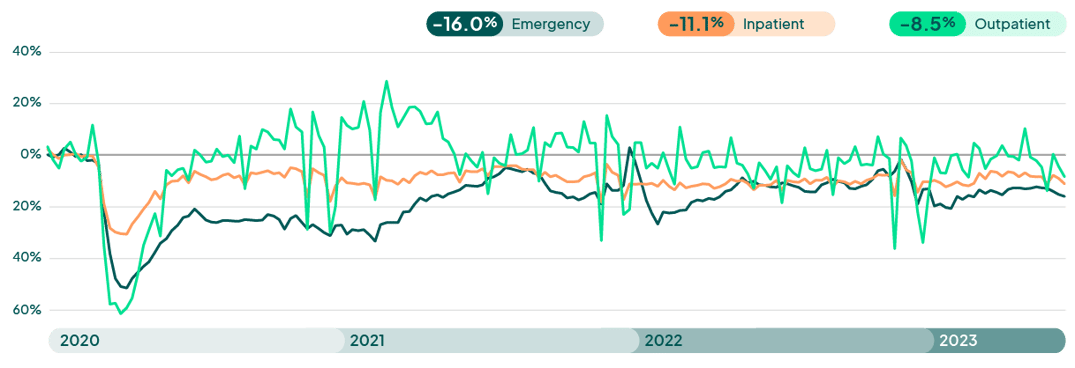

Hospital visit activity is smoothing into 2023, with a tightening of the band into Q3. The latest FinThrive volume report reveals volumes in a deficit of -16.0% (ED), -11.1% (IP) and -8.5% (OP) on a YOY comparison to 2020. Although there has been recovery in volumes, it has been sluggish, and performance has been well below pre-pandemic volumes in all areas. This trend will continue through 2023, and we might see a slight increase in volumes as we approach the winter, given the seasonal uptick in elective procedures and virus season. Inpatient and emergency department volumes will continue to represent a slow to recovery pace and will most likely result in a double-digit deficit for 2023. Acute volumes continue to shift to ambulatory segments such as free-standing specialty, surgery and other clinics. This is amplified by payer steerage and increased consumerism. Innovative healthcare organizations are investing in technology to accelerate their patient loyalty, revenue integrity and automation functions to offset volume, labor and supply challenges to margin.

Weekly Visit Volumes by Treatment Setting

Source: FinThrive Proprietary Data (n=500 hospitals)

Medicaid Redetermination Update

Kaiser Family Foundation has done a wonderful job of tracking the Medicaid activity surrounding the redetermination process. To date, over ten million (35%) beneficiaries were disenrolled in reporting states, while 18.2 million enrollees (65%), had their coverage renewed. There is large variability in disenrollment rates across reporting states, given the inconsistencies in state rules and administration. 71% of those disenrolled had coverage terminated for procedural reasons, due to issues such as the state having outdated contact information, or because the enrollee does not understand or complete renewal paperwork within a specific timeframe. “Administrative churn” describes these high procedural disenrollment rates as many who are disenrolled for these paperwork reasons may still be eligible for Medicaid coverage. Some states have even halted the terminations to reevaluate the renewal process to ensure citizens are getting the care they are qualified for. This amplifies the need for third party datasets to ensure accurate address and contact information are on file to ensure beneficiaries can be contacted, as well as technology in place to streamline the charity and benefit determination process involved in Medicaid determinations. Successful organizations are assembling task forces and leveraging technology to minimize the bad debt and care avoidance implications from loss of Medicaid coverage.

8th Annual Becker’s HIT Digital Health and RCM

Becker’s held its 8th iteration of the HIT digital health RCM conference in October. Key themes from this conference surrounded Artificial Intelligence, Payer Relations and Digital Health. This conference represents one of the key areas for thought leadership as the speakers, networking and content have continually become more relevant and qualitative. The conference started with a keynote from CIOs from prominent orgs – Common Spirit, UPMC, UT Health and others. They spoke about the importance of truly understanding AI, balancing priorities and leading beyond IT.

FinThrive along with customers, Shanda Richards (CPGH) and Mike Vigo V (UCSD), hosted a session on a new model to assess the impact of technology on the revenue cycle. The Revenue Management Technology Adoption Model (RMTAM) was presented by Jeff Becker, VP of Portfolio Marketing, FinThrive. The tool’s progress was outlined, including the 100+ organizations that have provided input on this model from their operations. The model evaluates on a two-fold approach – the value of RCM technology and its actual use (or prevalence) at organizations. This naturally places an organization taking an assessment on a spectrum of adoption, from zero to five. Attendees were invited to take an assessment for their organization, and I encourage you to do the same with this link.

AI is everywhere and Becker’s was not an exception, there were some good presentations with solid application of AI technology in real world tasks – prioritizing and automating tasks, taking the mundane from “schedgistrars” (hybrid patient access roles) and allowing them time to focus on complex issues, and most importantly – the patient.

Another theme from the conference surrounded a familiar favorite – payers. The tension between payer and provider was palpable. Close examination by both parties should afford what is, and is not, out of bounds from a contracting and payment perspective. Technology solutions that look at contract management, analyzing timing of payments and their shortfalls should be closely evaluated to succeed. Many of the presentations echoed this sentiment, but they were overshadowed by the immense frustration from the provider community over payer tactics. The industry must work together on mutual rules surrounding payment – or it will only get worse.

There was a lot of discussion on the importance of digital health. As consumers are engaged with all other industries digitally, it is time for healthcare to come to the plate. Several sessions discussed strategies with engagement with the patient as payer – they are consumers – shopping on convenience, cost, quality and others. Sessions spoke about engagement and loyalty, and most importantly the significance of the lifetime value of a patient – clinically and financially. Many sessions highlighted the need to connect with consumers on a digital level, and when they become patients, afford them a lifetime experience that delights them in getting their care at healthcare organizations.

Looking Ahead

The holiday season is fast approaching, and we may all get an early gift of realizing a partial to somewhat “near-full” recovery in the healthcare market. Margins are leveling and becoming positive, and patient volumes, as well as labor / supply costs are leveling. Organizations are encouraged to revisit financial and capital planning efforts that may have been placed on hold previously. Kaufman Hall pointed out that data and analytics will be critical to inform a strategy that closely examines market opportunity, strategic priority, risk, mission and organizational values. While financial and strategic holds may have been prudent in recent financial pressures, a delay to re-engage in strategic financial planning could threaten long term relevance and viability of organizations as they fall behind their competitors. Organizations should look to the fourth quarter of 2023 to carefully plan their 2024 growth strategies and quickly transition from recovery to expansion. I am hopeful as the marker continues to incrementally improve, and each quarter is showing marginal gains. Be diligent in your approach and outlook and aggressively evaluate service lines and costs to maximize revenue. Above all…be well.

Want to learn more? Contact us to talk to an expert or catch me at the next industry event.

About the Author

Jonathan G. Wiik, MHA, MBA, FHFMA

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.