By Jonathan G. Wiik, Vice President, Health Insights, FinThrive

It’s about time: hospitals finally posted a positive margin in December according to Kaufmann Hall’s latest flash report. That’s just one piece of a generally optimistic outlook on the rest of 2023 that several analysts recently shared. Let’s dig into their findings – and come up with a few predictions of our own.

Thought Leadership Webinar

Healthcare in 2023 and beyond — A financial outlook for revenue leaders

Presented by: Jonathan G. Wiik, MSHA, MBA, CHFP, Vice President, Health Insights, FinThrive

Jonathan discusses how successful organizations are using people, process and technology to change healthcare's financial paradigm.

McKinsey just published a 2023 Healthcare Sector report. It’s well done, and there is some positive info in here on recoveries/CAGR/EBITDA for the healthcare sector, as well as some positive news on anticipated growth for healthcare software and platforms (some indirect RCM). Other highlights from the report:

- Inflation is here to stay and is impacting operations in the sector for borrowing expense and operational/supply costs.

- Healthcare labor shortage disrupted the market and has created a deficit that will take years to resolve.

- Payers are expected to fair the best in the next year, followed by Ambulatory. Providers are a mixed bag.

- Software platforms have a >10% EBITDA (one of the few sectors) and a >10% CAGR (the only one in the category).

- McKinsey “expects accelerated improvement efforts to help the industry address these challenges in 2024 and beyond, leading to an eventual return to historical average profit margins.”

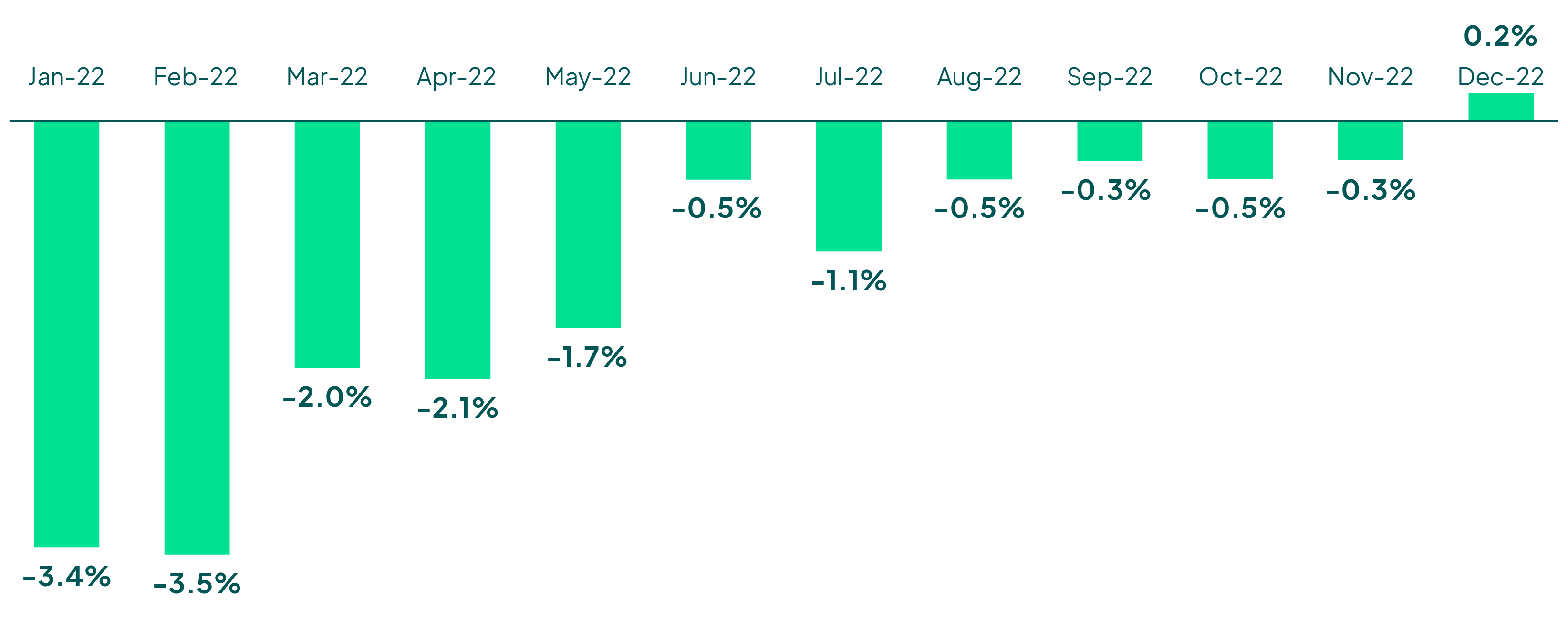

In other news, Kaufmann Hall just released the January report. Hospitals finally made it out of the woods, posting a 0.2% positive margin for December. Now that the deficit is there, however, hospitals will need to claw it back as it drained their reserves. Most of the rating firms and other experts in the field have indicated the labor and expense tsunami is ebbing back. It will be SLOW (I anticipate most of 2023, could be better, we will see), but we will see economic recovery in the sector at varying rates this year. However, I do not think it will come back materially in patient volumes. It will manifest in payer yield and patient loyalty/engagement efforts to maximize topline revenue. COVID shifted volumes away from hospitals for perpetuity in my view.

Operating Margin Index by Month

Source: Kaufman Hall January 2023 National Hospital Flash Report

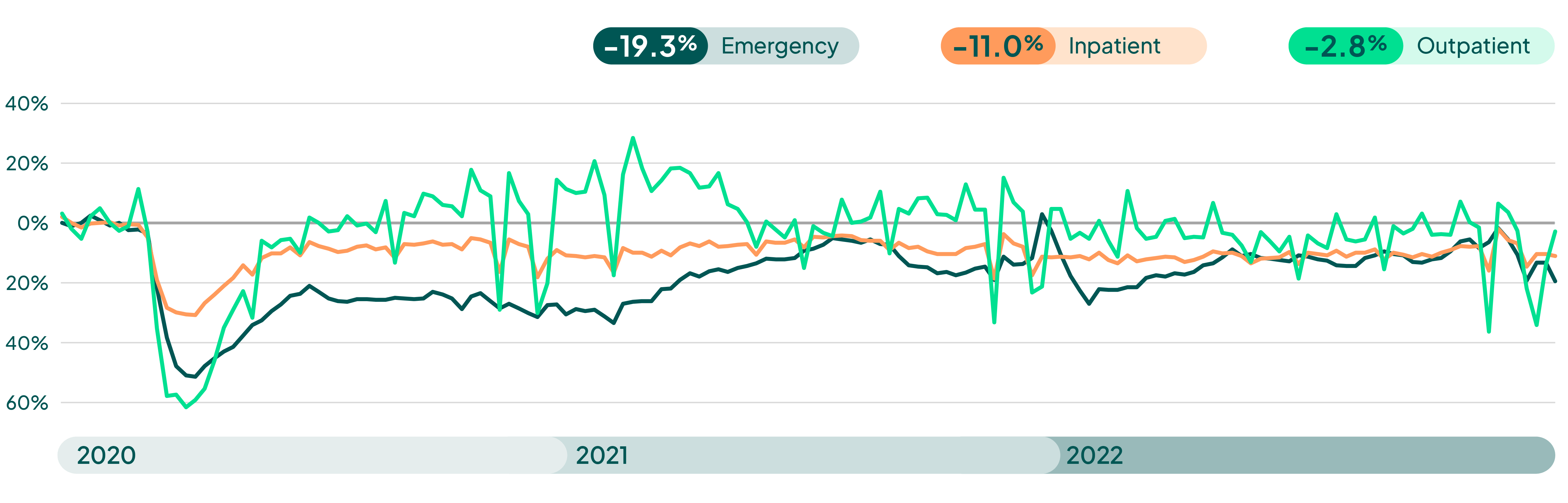

The latest FinThrive volume report reveals a deficit for 2022 in the 5-20% range across all settings. It will stay there except for outpatient. With these volatile volumes, cost control will continue to be a focus in labor (efficiency over replacement) and in vendor expense (consolidation). Technology partners in RCM are uniquely positioned to get in and help providers and payers; they just need to execute, especially in cash delivery and automation.

Replacement of legacy third-party systems will be considered for larger systems that are firing up projects to get back to plan, and automation will be there for those that want to transform their revenue management versus recreate a new version of the same thing. Yield-generating point solution adoption/optimization will be prevalent as cash is paramount right now. Health systems need to get back to triple-digit days cash on hand. Most took a big hit in 2022 and it had substantial impacts for most of the fragile hospitals now. I’m going to run an analysis of just how badly KPIs moved in 2022; stay tuned for that in our March insights blog.

Weekly Visit Volumes by Treatment Setting

Source: FinThrive Proprietary Data (n=500 hospitals)

To make matters worse, 15 million Americans are at risk to lose Medicaid. The public health emergency (PHE) expiration hits in April, which will impact one in five members of Medicaid. Successful organizations have an opportunity to insulate their members and patients by ensuring they have the correct contact information and that coverage is identified to ensure gaps and coverage risk do not manifest. This will be a major disruptor to the market.

Looking ahead: What’s coming down the pike in 2023

2023 will be a year of recovery for healthcare. As we see health systems and hospitals claw back margins, you will see increased friction between payer and provider. Providers are going to capitalize on payer profits and seek to make up their margins in rate increases. Payers are going to dig in their heels and do what they were asked to do – aggressively manage care.

With a split congress, we will also see increased regulatory oversight for transparency and surprise billing. In the State of the Union from President Biden, he indicated that “COVID-19 no longer controls our lives,” and this distraction is becoming manageable. There will be a concerted effort in Washington to lower prescription drug costs. President Biden indicated he and his administration will continue to expand and support Medicare and Medicaid and veto any legislation that attempts to cut it. He mentioned the focus on surprise billing as well.

The healthcare market is in the unique position of creating something different. As the industry financially recovers, it will be paramount to closely examine opportunities in technology to automate and drive more yield for providers. The news is promising, but we’re not out of the woods yet. There has never been a better – or more important – time to rethink revenue management.

About the Author

Jonathan G. Wiik, MSHA, MBA, CHFP

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.