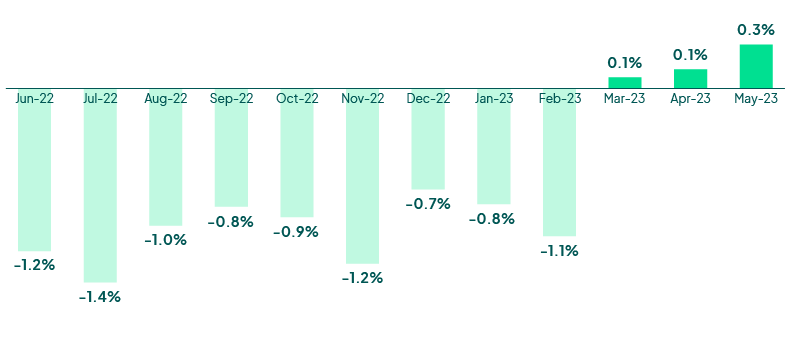

Hospitals are starting to see some daylight as we approach the second half of 2023. Per normalized data from a recent June Kaufman Hall report, signs of recovery continue with three consecutive break-even months. Volumes have continued to stabilize, with some acceleration of outpatient volumes. This, in combination with the leveling of staffing and supply costs (although still high), will continue to improve margins in the coming months.

Operating Margin Index by Month

Source: Kaufman Hall June 2023 National Hospital Flash Report

Source: Kaufman Hall June 2023 National Hospital Flash Report

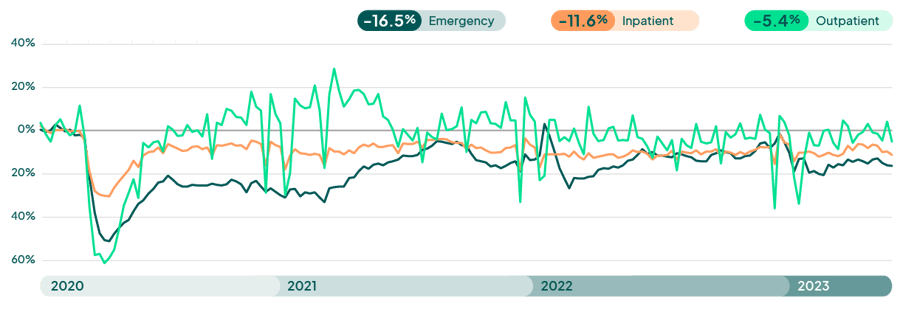

Hospital visits became less volatile in the first quarter of 2023. The latest FinThrive report reveals volumes in a deficit of -16.5% for Emergency Department (ED), -11.6% for inpatient (IP), and -5.4% for outpatient (OP) on a YOY comparison to 2022. Volumes will remain below pre-pandemic levels throughout Q2 2023 and into Q3. Outpatient volumes will continue to increase as we approach the fall, but overall, the volumes in all other settings will remain below normal. Inpatient and emergency department volumes will slowly recover and may approach deficits in the single digits into Q3 2023. Acute volumes continue to decline at hospitals as patients have supplemented their care pathways into telemedicine and alternative care settings such as urgent care and free-standing diagnostic centers. Payers are also steering coverage to these lower-cost care options to bend the cost curve. Forward-thinking hospitals will place emphasis on patient loyalty programs and digital strategies to accelerate frictionless onboarding and payment for services. Expect more partnerships and expansion in the ambulatory space as consumers continue to shift their care needs to those settings.

Weekly Visit Volumes by Treatment Setting

Source: FinThrive Proprietary Data (n=500 hospitals)

Medicaid Fallout

In May, the White House announced the end of the public health and national emergency declarations that were put into place in March of 2020. The “unwinding” of Medicaid’s continuous coverage provisions will have a ripple effect to all areas of the healthcare market. There are currently 15 million Americans who are at risk to lose Medicaid per the Assistant Secretary for Planning and Evaluation (ASPE, a division of HHS). This will impact one in five members of Medicaid. Providers, payers and state agencies must make a concerted effort to minimize disruptions in coverage and ensure barriers to care are mitigated. Every time there is a change in enrollment criteria, whether the beneficiary is eligible or not, it causes confusion and care is often avoided. Administrative “churn” will impact roughly 50% of the disrupted Medicaid enrollees (7 million) and outreach, education, and redetermination resources must all be elegantly executed in the coming year. Without them, organizations can expect to see disengaged patients, higher acuities and administrative burdens, which will strain already fragile hospital and payer workstreams. Payers can expect to see a level of disengagement and higher costs as patients defer care for fear of cost. Hospitals may have detrimental impacts to their bad debt portfolio. Organizations must ensure they have a solid plan in place and are leveraging technology to verify member/patient contact information, and that all possible areas of coverage are identified so care and payment are not disrupted. I’ll continue to discuss these month-over-month changes in my upcoming Q3 2023 insights post.

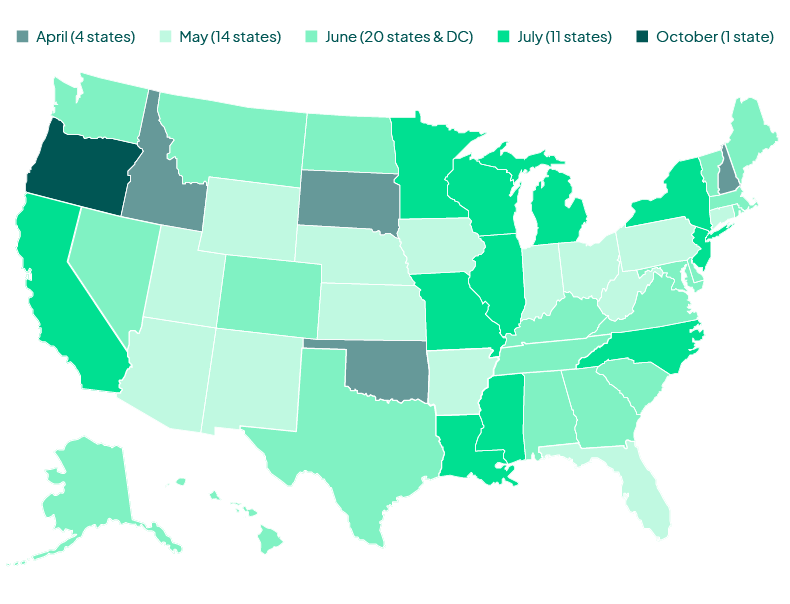

Most of the country have filed their intention to end the continuous enrollment requirements for Medicaid and Chip as of April and October this year. As mentioned previously, per the ASPE, 15 million Medicaid enrollees are at risk for losing coverage over the next 10-12 months. Per data reported in a July KFF report, 768,000 Medicaid beneficiaries have been disenrolled since the PHE wind down began. On trend, more than 10 million Medicaid enrollees will likely lose coverage during 2023 and into 2024. Given this, providers must have necessary planning, technology and resources in place to manage this disruption that one-in-five Medicaid enrollees will experience. Hospitals can expect an uptick in bad debt and transitions in payer mix as enrollees shift to health benefit exchange (ACA plan) and dependent commercial coverage or become uninsured. Healthcare organizations will need to ensure they’re confirming patient contact information in bulk through third-party technology and are also running insurance discovery sweeps monthly to confirm coverage is in place or has lapsed.

Month in Which Medicaid Disenrollments for the First Cohort of Unwinding Renewals are Expected to Begin

Note: These dates generally reflect the anticipated effective date for terminations for procedural reasons (e.g., not returning a renewal form). In the few states holding procedural terminations due to a CMS-approved mitigation strategy, or some other reason, the date represents terminations for the first cohort of KFF renewals, not including those due to a procedural reason.

Source: "2023 State Timelines for Initiating Unwinding-Related Renewals As of June 29, 2023" CMS

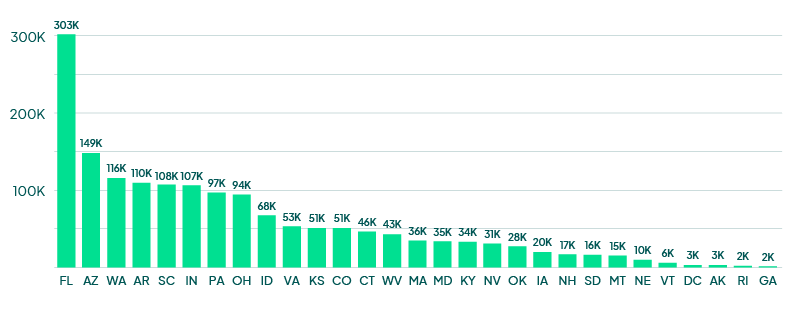

At least 1,652,000 Medicaid enrollees have been disenrolled in 28 states and DC with publicly available unwinding data, as of July 05, 2023.

State-Reported Medicaid Disenrollments

Note: *Idaho reports disenrollments for the Medicaid Protected population only.

Source: KFF Analysis of State Unwinding Dashboards and Monthly Reports Submitted to CMS

HFMA Annual Wrap-Up

Last week, HFMA held its Annual Conference in Nashville. The conference was electric in attendance; networking themes at the conference included provider market recovery, specifically around CFO focus and execution. There was also an emphasis on cash acceleration and expense reduction strategies. RCM optimization was also a hot topic, as organizations shared insights on automation, technology and integration. In addition, patient loyalty was discussed as more providers are understanding that payers will not be the sole source of revenue for the top line. Fitch Ratings also discussed the “75/75” conundrum, whereas 75% of a hospital’s revenue is fixed and the other 75% of labor and supplies are varied. As expenses outpace revenue, the industry’s financial outlook is not glowing, although the market is expected to have a better 2023 than 2022. Check out this full event recap from FinThrive’s Chief Growth Officer, Greg Lanier, for more.

Looking Ahead

As we approach the fall 2023, market metrics are showing signs of life. Margins are leveling and becoming positive, and patient volumes as well as labor/supply costs are leveling, too. Q2 2023 should prove to be a better one for hospitals than Q1. The recovery will be slow; however, organizations seem to have a path to payment that is working for the short term. Long-term planning should include strategies that closely examine the cost structure at their respective organizations. First and foremost, premium labor should be minimized, if not removed in its entirety, and supply chain optimizations should occur for long-term planning to buffer cost increases. Payer relations are critical to ensure that when renegotiating, hard data concerning yield, payments, underpayments, denials and administrative burdens are transparently and accurately communicated. From the technology side, specific to RCM, cash acceleration remains a key area of focus. Organizations should closely examine their RCM footprint and assess opportunities to optimize the work. Consolidate duplicative systems, look for a platform approach to capitalize on total cost of ownership, and accelerate solutions that are consistently driving yield to capture every dollar. Above all… be well.

Want to learn more? Contact us to talk to an expert or catch me at the next industry event.

About the Author

Jonathan G. Wiik, MSHA, MBA, CHFP

Vice President, Health Insights

Jonathan Wiik, VP of Health Insights at FinThrive, has over 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles at a large not-for-profit acute care hospital and prominent commercial payer before serving as Chief Revenue Officer. Wiik works closely with the market and hospitals on industry best practices for revenue management. He is considered an expert in the industry for healthcare finance, legislation, revenue management and strategic transformation.